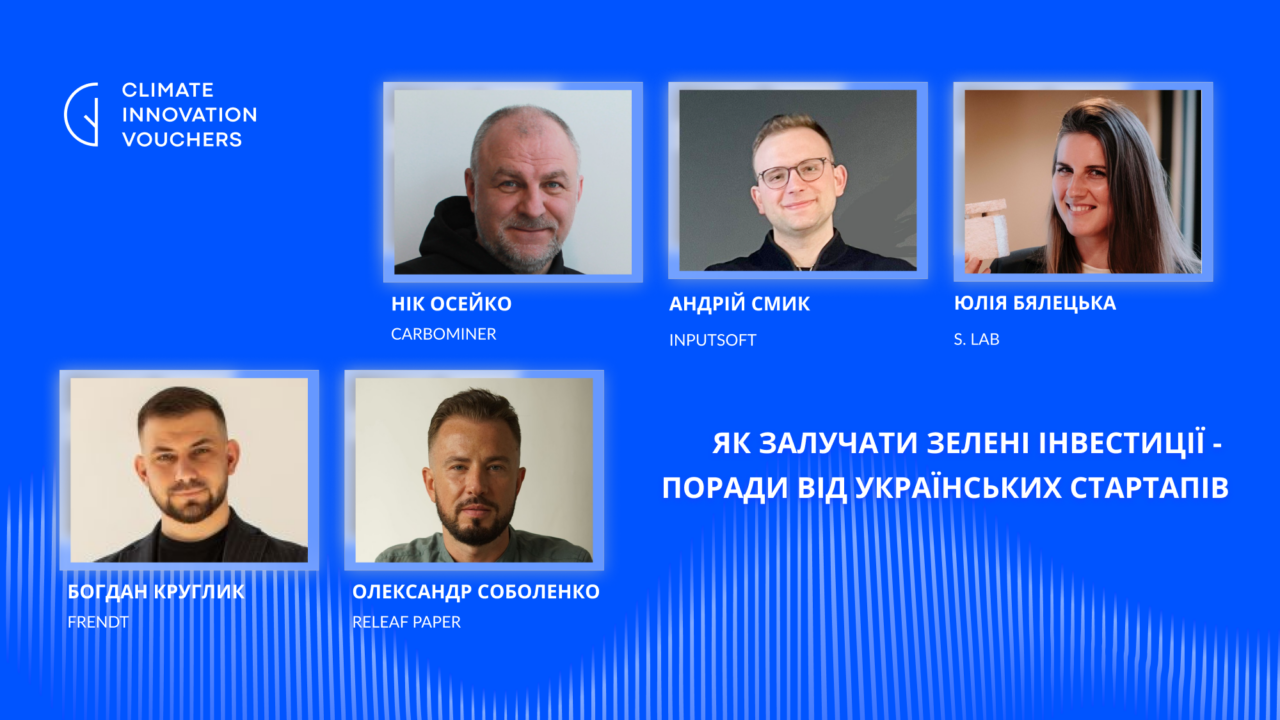

To attract green investments, it is worth focusing on PR tools, warm contacts, pilot projects and how the team turns the idea into a business. Grant funding can be quite a useful source of funding for startups, and mutually beneficial relationships with investors will help the company develop on a long-term basis. The participants of the discussion came to these conclusions "On the way to green investments. The view of businesses and investors", as part of the presentation of the new wave of the grant competition "Climate Innovation Vouchers", organized by Greencubator.

Beneficiaries of the "Climate Innovation Vouchers" project, Nik Oseyko from Carbominer, Andrii Smik from InputSoft, Yuliya Bialetska from S. LAB, Bohdan Kruglik from Frendt, Oleksandr Sobolenko from Releaf Paper, told about their experience in finding investors, preparing and changing the company to attract investments.

We offer an overview of the key moments of the conversation (full video https://t.ly/tPsuy).

Oleksandr Sobolenko, CEO, Releaf Paper, :

"A colossal number of grant programs opened for Ukrainian startups in 2022. Such opportunities, which opened up in the year of a full-scale invasion, had never been seen before. Keep an eye on them. Subscribe to the main profile resources. Be sure to subscribe to Greensubator. Subscribe to the Ukrainian Startup Fund to keep up to date with everything that is happening in the startup ecosystem. They identified a grant, assessed their capabilities, applied, received money...

If it is a grant, read the terms of the program carefully. The requirements immediately state what the grantor wants to see from you. Your task is to assess whether you can adapt yourself, your team, your product to these requirements. Do it quickly, accurately and efficiently. Remember that besides you there are dozens, sometimes hundreds, in our case thousands of companies that also want to receive this money. And you compete with them. Be better in your application, more accurate, faster, more successful. For complex grants of large amounts, don't be afraid to bring in consultants…”

Bohdan Kruglyk, CEO Frendt:

"...We received a grant from the EBRD, we have experience in attracting crowdfunding, experience in attracting state grant programs. If we are talking about the EBRD, then this is a responsibility, this is a change in the company as a whole, a change in the approach to business from the third world to the first, this is a change in the culture in the company in terms of understanding and perception, why we are doing it, where we are going, and what is the responsibility before us . The experience we gained really changes your approach... People who use grants are about the road to Europe and European values, about responsibility, about the background you have, because he, the investor, also looks at experience of your team and the value you give... About investment, it's about the soul. Therefore, attract financing, receive funds, change..."

Yulia Bialetska, co-founder and CEO S. LAB:

"Attract grants at any time, from any programs that are available to you, for which you are suitable. Various pitch competitions and competitions are also included there, because usually competitions have a very strong training program. Plus, you can win a small, but still significant amount as a prize for your stove. Accordingly, these funds can also be spent to develop your startup..."

Nick Oseiko, founder and CEO Carbominer:

"At events, we usually got to know investors, representatives of investment funds. And then it already successfully helped us close investment deals. Events are probably one of the best means of attracting investment..."

Andriy Smyk, co-founder and COO InputSoft:

"Of course, to maintain a good relationship with investors, because investors are not about money, it's more about partnership and the long game..."

Oleksandr Sobolenko, CEO Releaf Paper:

"The strategy for venture capital is radically different. Sometimes you have to work through 100 investors in order to get an important investment. You will be told "no", you will be ignored. Accept rejection as normal. Analyze why you were rejected. Improve your offer, try again. We tried 100 times before we actually got a major investment. The second recommendation is to visit international startup events. Investors will approach you there themselves. The third recommendation - if you create a cool innovative product, the world media will write about you. And investors themselves will come to you. That is, strategy is a combination of various factors..."

Nick Oseiko, founder and CEO Carbominer:

"...Think about preparing a campaign to receive investment, if there is an opportunity. If there is no such possibility, then at least about the pilots. It will be the best…”

Andriy Smyk, co-founder and COO InputSoft:

"There is no universal solution that will make the Ukrainian green sector successful. These should be accelerators, incubators, a complete ecosystem aimed at the development of innovations. It is also important to have a pool of companies that are willing to test innovative developments and, in fact, create the first opportunities for innovators. It is very important to build the ecosystem itself, otherwise there will be an opportunity to make some individual successful projects, but to achieve a systemic breakthrough, we must build the ecosystem itself…”

Nick Oseiko, founder and CEO Carbominer:

"We need a harmonious combination of different elements. We need more innovators, more teams, more startups. We need more funding. And here I pay attention to both public and private funds..."

Yulia Bialetska, co-founder and CEO S. LAB:

"We need to create a community that will include public organizations, government, startup founders, companies, accelerators, investors, business angels. I believe that such a community can change the entire ecosystem and make cleantech successful by working on requirements that should be different for startups. They also require significant public investment..."

Roman Zinchenko, co-founder Greencubator, which implements the "Climate Innovation Vouchers" project:

"We need a "pure" technological "mafia" (family - note). Let's look at the European Union and the United States - they have a significant number of companies founded by people from such "mafias" as PayPal, former employees of Skype, Harna, Rocket Internet and others. And, of course, this is a great way to grow real entrepreneurs, people with money, missions and visions..."

We would like to remind you that on July 20, the regular acceptance of applications for receiving grant assistance for the competition began.Climate Innovation Vouchers” from the EBRD for Ukrainian small and medium-sized businesses. Ukrainian businesses will be able to receive up to 50,000 euros for the development or implementation of climate technologies that reduce greenhouse gas emissions and increase the efficiency of energy consumption. The deadline for submitting projects is September 30, 2023. You can find out more about the conditions of the competition on the website https://climate.biz/formembers/. You can apply via the link - https://t.ly/GPHVC.