Startups and investors must interact successfully. This requires good personal relationships, belief in success on the part of the founders and an assessment of real factors such as market fit, financial stability and team flexibility. Such criteria for their decisions were voiced by investors during discussions "On the way to green investments. The view of businesses and investors“.

Most of the participants in the discussion noted the importance of personal contacts and charisma of startup founders at the initial stage of acquaintance, but also emphasized the role of objective factors such as business model, financial indicators and market fit. They also determined that a company's ethics, motivation, and positive impact on society are integral to an investor's evaluation of a company.

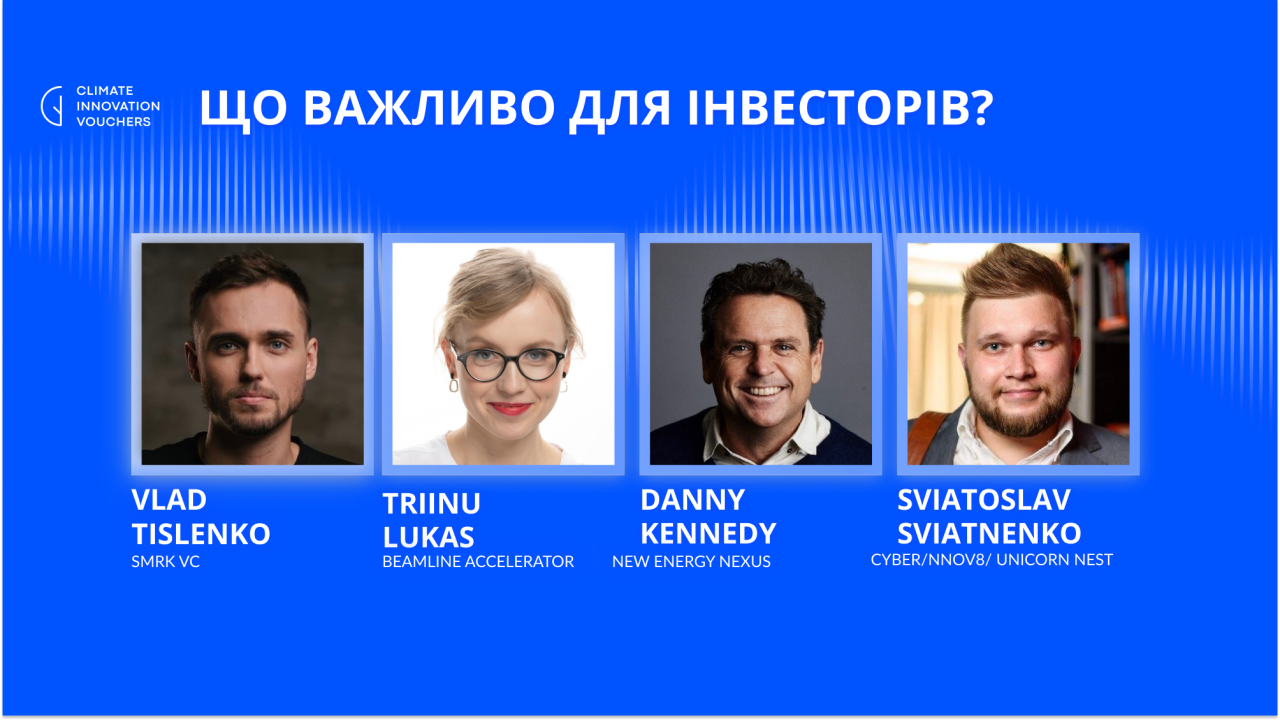

Vlad Tislenko (SMRK VC, partner) emphasized the importance of contacts and personality of the founder, ethics and motivation for successful cooperation. Trinu Lucas (Beamline Accelerator, CEO) emphasized such selection criteria as impact on the climate and financial potential, team dynamics and shared values with the investor. Danny Kennedy (New Energy Nexus, CEO) emphasized the importance of a thorough analysis of technology, performance, market share and the model by which the company plans to conquer the market. It is very important that the team is able to overcome difficulties and obstacles. Svyatoslav Svyatnenko (Unicorn Nest, vice president), in turn, emphasized that the initial idea of a startup can change in accordance with the market and needs. He also emphasized the importance of team evolution as the company grows. According to him, the ability to overcome challenges for the company is an extremely important factor.

We offer the key opinions of the panelists (full video) when discussing the question of where and how investors find potential objects for investment, and how they make decisions.

Vlad Tislenko, partner, venture fund SMRK: we expect real focus and dedication

"How I personally make decisions. The objective part is how well the startup fits our investment manifesto. And the subjective part is more based on intuition regarding cooperation with a certain startup on a long-term basis.

We invest in people, and the founder's charisma is a really important factor. Building a startup is hard work, so we expect true focus and dedication from founders and entrepreneurs.

On the other hand, financial indicators, business model are also of significant importance. For example, we expect the business model to scale. We prefer companies with a clear signal about the presence of a commodity market.

Finally, ethics and motivation are important. We prioritize founders who focus not only on financial success, but also on the positive impact their company can bring to people and the environment…”

Trinu Lucas, CEO, Beamline Accelerator: It is not possible to achieve further investment without light in the eyes and vision

"We directly involve companies to participate in start-up events. Over time, we meet companies that have already participated in such events. We also have great partners who provide us with early stage companies to advise us on who to invest in. We advise startups not to limit themselves only to their office and communicate with investors not only on LinkedIn.

...When analyzing companies at the first stage of selection, the main criteria for us are the impact on the climate and the potential for financial growth. We pay attention to the team and its dynamics, to the extent that our philosophy coincides with the founders. At the third stage, we interact with partners and the investment jury to conduct additional technology analysis.

Charisma often still plays a role at an early stage, as our goal with the startup is to get further investment, and that cannot be achieved without the light in your eyes and the vision you bring…”

Danny Kennedy, CEO, New Energy Nexus: The numbers may change, but the obstacles are overcome by people

"First of all, we look at technologies, performance, market share, the model itself is also important, the technologies with which the company will conquer the market... And the company's management, can the team realize the mission... We need to look at both the numbers and the charisma of the leader, because numbers may change, but people overcome obstacles…

Historically, we have not had a long experience in Europe, but we are very interested in what is happening in Ukraine and in the activities of Greencubator. The latest panel discussion with amazing entrepreneurs is a testament to the great work and ecosystem of investors. We are excited to meet you all and see it. We believe that what will happen in Ukraine in the years after the victory will be one of the greatest opportunities for energy transformation in the world...

Many investors point to three main aspects that they pay attention to. The first is the market. Is it big enough to achieve the returns their limited partners expect from them as investors? The second is your model. Is your business innovative, do you have technology or a special approach to this market that will allow you to win in it? Do you have an advantageous position? Are you and your team capable of bringing this model to market?

Most investors say that it is these four key aspects that they pay attention to. We add the fourth "M", namely the mission. We are very interested in overcoming the climate crisis, as well as in the opportunity to lift everyone on the waves of the energy transition and climate solutions that already exist. In the conditions of difficulties with the destruction of the energy system in Ukraine and the problems that the country is facing, we will see this on a real example in the near future..."

Svyatoslav Svyatnenko, founder of Cyber/nnov8, vice president of Unicorn Nest: the presence of a team that continues to work even in difficult times

"My experience shows that the initial idea may change a little during the development of the startup, it will be refined to match the market. I would also emphasize that building a great technology, a great product, and a great company are three different tasks, and you may need different skill sets. It's great when the original founding team evolves with the growth of the startup in skills, knowledge, but sometimes you need more people, different skills to really build a big company that will change the industry and grow quickly.

I would also like to emphasize that when it comes to the team, it is not only the founders and leaders of the startup, but also previous investors and consultants. This is critical, because the creation of a large company requires the efforts of the entire team, and the relationships formed during the development of a startup are not so easy to change. Investors and people associated with the company will interact for a long time.

It is important to have energetic founders who can drive sales and inspire others. But in the end, it all comes down to results.

Even after attracting investment, the real challenges are just beginning. Therefore, we would greatly appreciate the presence of a team that is able to continue working even in difficult times..."

Discussion "On the way to green investments. The view of businesses and investors" took place as part of the presentation of the new wave of the Climate Innovation Vouchers competition, which is held by Greencubator. As part of the competition, Ukrainian businesses can receive up to 50,000 euros for the development or implementation of climate technologies. More about the conditions - https://climate.biz

READ ALSO: How to attract green investments - advice from Ukrainian startups

Beneficiaries of the project told about their experience of finding investors, preparation and changes in the company to attract investments.Climate Innovation Vouchers” – Nik Oseyko from Carbominer, Andrii Smik from InputSoft, Yuliya Bialetska from S. LAB, Bohdan Kruglik from Frendt, Oleksandr Sobolenko from Releaf Paper.